After the Subprime Meltdown -- A Global Political Upheaval

Welcome to the Chinese New Year, February 8, 2008 edition of the SatyaCenter newsletter. Warm greetings from your Editor, Curtis Lang.

Yesterday’s New Moon Eclipse marked the beginning of the two week celebration of Chinese New Year, ushering in the Year of the Granary Rat, promising a much more earthy and pragmatic energy for 2008.

Chinese and Western astrologers agree that the New Year stars forecast an extremely challenging and complex state of affairs around the world, and also foster a climate in which spiritual practices can flourish and spiritual practitioners receive extra support in their efforts to attain new summits of clarity and vision.

You’ll find links in this newsletter to a very insightful and comprehensive two-part article by Esoteric Astrologer Malvin Artley which provides a forecast for 2008 utilizing the tools of Esoteric Western astrology and Chinese astrology to evaluate an extremely complex constellation of stellar influences that is unique to this year and will certainly impact humanity’s collective consciousness for many years to come.

The stars impel, they never compel, according to the ancient Wisdom Teachings, and we are always free to create our own reality within the constraints imposed by our karma, our consciousness and the structure of material creation.

This month, the stars are impelling me to devote this newsletter primarily to an analysis of the impending global financial storm, centered in the United States.

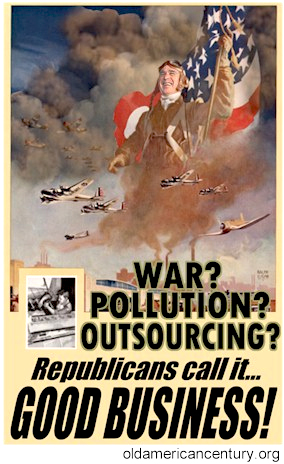

I believe we are witnessing the slow motion collapse of the current financial system, known as “globalization”, which is shorthand for a whole range of political, economic and social policies, including laissez-faire Utopian capitalism and its trickle-down economics, Reaganomics, free trade and the leveling down of global wages, human rights and environmental protection, financial deregulation and corporate oligarchy.

I believe we are witnessing the slow motion collapse of the current financial system, known as “globalization”, which is shorthand for a whole range of political, economic and social policies, including laissez-faire Utopian capitalism and its trickle-down economics, Reaganomics, free trade and the leveling down of global wages, human rights and environmental protection, financial deregulation and corporate oligarchy.

For over a decade social reformers have waged an intermittent but high-profile mass movement protesting the current system, and anti-globalization protests have become a common occurrence from Washington to Europe to Japan.

But now it looks like this mass campaign will not be necessary to topple the neo-liberal economic ideology that has had the world in its fevered grip for the last twenty-five years – the system is toppling of its own weight in a slow-motion collapse that will make the chaos that accompanied the unraveling of the Soviet Empire look like a Boy Scout jamboree.

Isn’t that just a little bit excessive, you may ask. Could I be hyper-ventilating? Perhaps too much pranayama has fried my brain. Well, unfortunately, the more pranayama I do the sharper I get and the more this looks like a major financial meltdown of historical proportions.

I’ve been a financial journalist for thirty years at local, regional and national publications and with Ameritrade, the online financial powerhouse. I was one of the first journalists to uncover the massive fraud and abuse that sparked the infamous $500 billion savings and loan crisis of the late Nineteen Eighties, and I remember that it was very difficult in the early days of the crisis to evaluate the scope and depth of the problem.

In late 1986 and 1987 sources in Washington and Wall Street assured the public over and over again that the problem in the savings and loan system was really not so big, a few billion dollars maybe, and limited to a very few rogue banks, and not something that would impact the average person at all, certainly nothing to disturb the smooth rise of real estate values.

In 1987 I predicted a $500 billion bailout, and a massive real estate slump across the Sunbelt, where the majority of problem S&Ls were located. My predictions were limited to small publications like “The Texas Observer” because representatives of the mainstream media, including “Mother Jones” and other pillars of the progressive press told me that I was insane.

Just by co-incidence the Presidential tickets of both major parties included individuals with a thick web of business and political connections to the most deeply troubled S&Ls. On the Republican side, George Bush, Sr., and on the Democratic side, Lloyd Bentsen, the Vice-Presidential candidate.

It was only AFTER the 1988 election that the full scope of the problem was revealed to the public and the bailout began in earnest.

Now, as Yogi Berra used to say, “It’s déjà vu all over again!”

We’re in an election year, and this time the real estate slump is preceding the financial crisis. Economists are concerned that there may be a recession, housing values are dropping all over the country, and Wall Street has suffered some very substantial losses already this year, which are mirrored in the wobbly and weakening values of stock exchanges across the globe. There are rumors that big banks, hedge funds, Wall Street giants, insurance companies, and institutional investors holding the esoteric financial instruments composed of multitudes of pieces of individual mortgages, and derivatives thereof, may be in for major losses.

In 1987, I found $50 billion in “goodwill” issued by the Federal Home Loan Bank Board to troubled S&Ls in Texas alone, to cover up their losses. It was simple. I looked in the annual report of the regional Federal Home Loan Bank that regulated and acted as lender of last resort for Texas S&Lsand the amount was clearly listed. I found more in other regions in other FHLB annual reports. Easy as pie.

This time it’s not so easy to scope out the impending financial crisis. Banks, Wall Street firms and other non-bank financial players have been steadily de-regulated over the last twenty years, making it easier for them to take risks with other people’s money, to socialize losses and to privatize gains.

Over the last year I’ve been watching the website of Nouriel Roubini, a Professor of Economics at New YorkUniversity. Dr. Roubini has been warning of an impending crisis in the global economy for over a year. At first he was presented as a kind of fringe player in the mainstream media, a Cassandra whose pessimism was just not credible.

Now he is a speaker at the Davos conference, he is quoted reverently in the largest newspapers in the world and his website has been named one of the top economic websites in the world by BusinessWeek, The Economist, Forbes and the Wall Street Journal.

There are links to some amazing stories by Dr. Roubini in this newsletter, which are quite long and somewhat technical, but which provide the reader with a detailed accounting of the scope and breadth of the impending crisis.

Here’s an overview:

Dr. Roubini and his crack team of economic experts have quantified $1 trillion dollars in impending losses in the global financial system.

There are obviously large losses in the sub-prime mortgage market, which is now common knowledge. Millions of Americans are in danger of defaulting on their home loans, especially those with variable rate mortgages and those whose houses have dropped in value as the housing bubble popped.

Dr. Roubini predicts losses of $200-300 billion in the subprime market, which will adversely impact banks, mortgage companies, Wall Street firms, hedge funds, and big investors worldwide.

Roubini predicts a drop in housing prices of up to 30%, which will have many much more widespread negative economic effects.

Many so-called “prime” mortgages were sold to consumers utilizing the same techniques that were perfected in the sub-prime market. No verification of income was required for what I call the “Tony Soprano loan”.Low teaser rates were provided to high-end homebuyers who sought to flip their investment properties before short teaser rate fuse burned down and they were scorched by fast steep escalations of payments. Over optimistic appraisals of properties were so common that it was extremely easy to borrow 100% or more of the purchase price on homes that now are dropping value like hail on a February day on the top of Mt.Washington.

Goldman Sachs estimates another $150 billion of losses in the “prime” mortgage markets, as a result of these practices. The widespread fraud in mortgage markets is now under investigation by Andrew Cuomo, the New York state attorney general, but you can bet your bottom dollar there will be no culmination to this investigation until well after the 2008 election cycle and the 2009 inauguration has taken place.

The collapse of the mortgage markets and the slump in housing prices will cause lenders to vastly constrict the supply of credit nationwide in all sectors.

The supply of credit to individuals and companies who are good credit risks will undoubtedly begin to dry up as banks and other creditors are forced to use their cash to paper over huge losses. The ability of the average consumer to buy stuff on credit will be doubly impacted.

The era of the painless home equity loan vacation or luxury car or vacation home is over. Second, the overextended consumer will experience an increasing drain on their income as they must pay more and more interest on a huge overhang of personal debt in situations where refinancing becomes a privilege rather than a right.

Consumers are also burdened with huge credit card debts and big auto loans. There is every reason to believe that the defaults in the mortgage market will spread to these other consumer debt sectors, resulting in major losses for lenders and major pain for consumers unable to maintain their payments.

Lenders will be ratcheting up interest rates to consumers and less than stellar corporate credit risks even in a very low interest rate environment created by the Federal Reserve to help boost the economy, because the lenders are themselves so close to bankruptcy that they will need to price-gouge wherever they can to create the big profits they need to offset mega-losses.

Lenders are in trouble because big banks, Wall Street firms and hedge fund, along with major institutional investors, are all loaded to the gills with high-interest bearing debt instruments created from the toxic mortgages fashioned fraudulently during the Bush Jr. real estate boom. These complex instruments contain portions of many, many mortgages packaged together to spread the risk of such instruments more widely and thus supposedly manage the risk more effectively.

In another effort to manage risk, de-regulated banks were encouraged by Bill Clinton, Alan Greenspan and George Bush Jr. to create and hold large quantities of these collateralized debt obligations (CDOs) OFF their balance sheets, so they could maximize their returns without having to set aside capital to cover any potential losses in the event of a problem. These toxic CDOs were sold worldwide to many many large players.

Below you’ll find a link to an excellent article by Pam Martens indicating how the big banks and Wall Street firms took advantage of Greenspan’s and Clinton’s banking deregulation to blow financial bubbles and to avoid the prudent and expensive steps to hedge against later losses, secure no doubt in the knowledge that they were “too big to fail”.

Dr. Roubini estimates that there are a few hundred billion dollars of losses hidden in the CDO sector. Because the banks must now pony up cash to cover their losses, they are in big trouble. The fact that these toxic debt instruments have been sold in capital markets worldwide insures that the economic contagion has spread to every stock exchange in the world, to most major institutional investors, and thus contaminated the entire global economy.

Thus we are witnessing the first major crisis of globalization, the culmination of twenty-five years of financial deregulation and Utopian laissez-faire capitalism as practiced by Ronald Reagan, Margaret Thatcher and the scions of Anglo-Saxon neo-liberal economic dogma.

There were also insurance companies who blessed the toxic paper peddled by the big banks and capital markets during the Bush housing boom. They certified that the computer-generated CDOs had spread the risk around sufficiently that even sub-prime mortgages could be classified as AAA investments and sold to institutional investors for a premium, and that those investors need not do due diligence investigations into the CDOs because they were so guaranteed by the insurers. However the insurance companies are very thinly capitalized and they do not have the financial strength to make good on their guarantees as hundreds of billions of dollars of those CDOs go bad.

Therefore there are unknown losses lurking in their balance sheets. Already there is a plan to provide $10-15 billion in bailouts to these players, but Dr. Roubini believes they will need a bailout many times that size. Who will provide the money for the bailout? Ultimately, US taxpayers are the most likely suspects, even though these insurers are not part of the US regulated banking system, and the US has no obligation to bail them out. After all, if they fail, then the entire CDO universe devolves into a sewer of toxic paper with very little value, and the collapse of major financial institutions worldwide is virtually guaranteed.

Nevertheless, the downgrading of the value of these insurers will certainly cause another $150 billion of CDO losses says Dr. Roubini.

This will potentially cause major problems for troubled banks, for municipalities holding toxic CDOs and for institutional investors like mutual funds who loaded up on high-performing CDO junk.

It is worth noting that the Bush years also saw a resurgence of leveraged buy-outs financed with junk bonds, a kind of financial 80s retro chic moment, and these junk bonds were fashioned into high performance financial instruments that pieced together bits and parcels of many, many LBOs that were then “insured” and given a AAA investment rating. There is every reason to believe that these LBOs created companies loaded with debt and unlikely to meet their financial obligations. The junk bonds and junk financial instruments created to finance their operations are also surely worth much less than face value. This will certainly lead to corporate bankruptcies and further ugly problems for big banks and other big holders of corporate junk.

More ominous are the problems in the esoteric market for credit default swaps (CDS) that were engineered by computer wizards to manage the risks entailed by the investments in junk bonds. Dr. Roubini estimates there are approximately $50 trillion worth of such instruments, and says that losses of somewhere between $20 billion and $250 billion are quite likely, with his guesstimate being much closer to the high end of the range predicted. These losses will impact Wall Street firms, hedge funds and insurers of financial instruments, with the potential to destabilize the entire stock exchange.

The problems in the mortgage markets, the banking system and the stock exchanges are spreading to other areas of the economy.

Commercial real estate is the next area to head south. Dr. Roubini points out that “The CMBX index is already pricing a massive increase in credit spreads for non-residential mortgages/loans. And new origination of commercial real estate mortgages is already semi-frozen today; the commercial real estate mortgage market is already seizing up today.”

Meanwhile, Dr. Roubini predicts a generalized credit contraction amounting to some $2 trillion. Roubini sees a danger that “A contagious and cascading spiral of credit disintermediation, credit contraction, sharp fall in asset prices and sharp widening in credit spreads will then be transmitted to most parts of the financial system. This massive credit crunch will make the economic contraction more severe and lead to further financial losses. Total losses in the financial system will add up to more than $1 trillion and the economic recession will become deeper, more protracted and severe.”

Dr. Roubini believes that the convergence of these financial problems will lead to substantial bankruptcies in the banking sector and the need for major bailouts of financial institutions. These bailouts are already underway. Dr. Roubini says that “Already Countrywide – an institution that was more likely insolvent than illiquid – has been bailed out with public money via a $55 billion loan from the Federal Home Loan Bank system, a semi-public system of funding of mortgage lenders.”

This stealth bailout is only the first of many to come. Recall that many of the financial players involved in this global financial crisis are mainly not part of the US banking system, operating outside the US regulatory umbrella, and not covered by any US government guarantees. Recall that a substantial amount of fraud and abuse has already been noted.

Yet bailouts of mortgage companies, insurers, and others are proceeding quietly, behind closed doors, without any public discussion, without any public debate, and without any politicians demanding an explanation or accountability or any type of recompense to the US taxpayer for bailouts being done today, or being contemplated for tomorrow. Remember we are looking at easily $1 trillion in losses, and thus $1 trillion in bailouts.

I think it is clear from this brief overview of Dr. Roubini’s economic forecast that we have a substantial public policy problem here, a political problem as well as an economic problem.

Reaganomics, globalization, neo-liberal economic models, financial securitization, banking deregulation, and trickle-down economic models based upon the sanctification of Wall Street’s conventional wisdom are now collapsing in a spectacular global financial meltdown.

In addition, the New York and London financial markets’ reliance on financial industries and real estate to provide an economic locomotive that would pull the rest of the world into a new realm of prosperity are disappearing like fog at the dawning of a scorching tropical summer day.

Meanwhile, US taxpayers are being set up to bail out the extremely rich institutions and individuals who have profited the most by creating the present debacle. This is an unacceptable, immoral, and undemocratic outcome, to say the least.

It is time to have a full-throated public discussion about the necessary re-structuring of our financial system so it will benefit everyone, and not just the elites who gamble with our world’s financial future in their members-only digital casinos, secure in the knowledge that they will get to keep all their winnings, and that in the event they lose their shirts, Uncle Sam will be happy to buy them a new tuxedo in time for them to appear at the next glittering virtual financial soiree.

It is hardly surprising that the Presidential candidates in America have no stomach for such a discussion. This crisis is a bi-partisan crisis. It is a crisis created by the last twenty-five years of consensus governance, and implicates all of Washington and Wall Street.

Unfortunately, just bleeding American taxpayers for a trillion dollars or so will not be enough to avoid a global recession, and perhaps a global loss of confidence in the Federal Reserve, the stock exchanges, and the banking system. Nor will a Gargantuan bailout necessarily guarantee that we can avoid a lengthy recession, perhaps to be followed by a long-lasting global depression.

Reregulation of the American financial system is necessary to avoid a repetition of this Mother of all Financial Collapses. This crisis is partly caused by the immense concentration of wealth in fewer and fewer hands, which means that wealthy institutions and individuals have vast pools of “hot money” available to them, and they are chasing high yield in risky financial instruments fabricated from risky real estate deals, investment fads and risky corporate restructurings that are sold around the world in various stock exchanges. This hot money chases high yield and as it flows into various types of investments, bubbles are created. Thus we have a bubble economy. First the commercial real estate and LBO bubble of the Eighties, then the dot.com bubble of the Nineties, then the LBO and real estate bubble of the Bush Jr. years.

Meanwhile, the average American is suffering. The middle class is dwindling. Health care and decent retirement are luxuries for the corporate lifers working at big institutions. And the upper middle class finances its MacMansion lifestyle on debt and risky investments.

The fact is that we have a crisis in demand in America, because of the lack of good jobs due to outsourcing and the erosion of public education, massive twin deficits because of low tax rates on the rich and reckless Imperial military spending on the national security state, and a financial crisis brought about by deregulation.

The next administration will have to do several things: There will hae to be a bail out for the big banks and other non-bank players in the collateralized mortgage markets. They are opaque, so there is no way to estimate the losses as there was prior to the S&L debacle, when I found the truth in the fine print of FHLBB annual reports by totaling up “good will” which meant losses, and the truth was suppressed until after the 1988 election.

The government bailout will be huge however, that goes without saying. A few hundred billion, I imagine is a good starting number for it.

In addition, there will have to be government action to revive the housing market. I suspect that the Federal housing agencies Fannie Mae and Freddie Mac will also need a bailout.Those who are hardest hit by the housing debacle are African-American families, who can least afford the pain. I recommend that the value of mortgages be reset to reflect the present value of houses across the country, and that as part of the price for the bailout, lenders take a haircut and lower payments and principal to the present market value of houses upon request of troubled homeowners.

To afford all this the Bush tax breaks for the rich should be repealed and a transaction tax levied on risky securities deals.

In addition, the federal government needs to create a safe environment for capitalization, creation and growth of a huge new industry in alt.energy and infrastructure redevelopment.

Because we are looking at a very long-term financial crisis, it is prudent to jump-start the economy by investing in infrastructure and creating federal jobs to revive America’s aging infrastructure, focusing especially on a massive national system of commuter and long-distance trains, and on energy efficient and environmentally sound water borne transportation.

It is time to scale back our $1 trillion a year budget for global warfare and imperial domination, which is misleadingly labeled as “defense spending” and “the war on terror”. It is time to use a large portion of that money to provide tax incentives and regulatory relief for entrepreneurs who seek to create the next generation of energy efficient appliances, cars, homes and offices, and the next generation of alternative energy producing technologies. Nuclear power and coal should be excluded from this federal program, because they are yesterday’s filthy solutions to tomorrow’s critical problems. In this way, just as government created the original Internet, the federal government can create the nucleus of a new American alt.energy industry which can lead the world into a post-oil future.

There is much much more to be done, but these are first steps. Without something of this magnitude I think the crisis will recur and recur getting worse and worse until some major, extremely painful restructuring of our economy and society takes place.